ALTAR Score™: How we rate ETFs

Ultimately the goal of conducting investment research is to help investors make money. To that end, we calculate an ALTAR Score™ — short for AltaVista Long Term Annual Return forecast — for each ETF we cover, which summarizes the results of our fundamentally-driven analysis. Details of ALTAR Score™ calculation for both Equity and Fixed Income ETFs are below.

|

How this benefits investorsInvesting is about the future. Our ETF rating works by helping you find value going forward, not simply telling you what has performed well up until now. Most competitors' ratings are based on past performance. As a result, they encourage investors to allocate assets to areas that have already increased in price significantly, and away from those that have already fallen. Simply put, this is a buy high, sell low strategy! The ALTAR Score™ works differently by encouraging investors to dynamically allocate assets away from areas that may be overheated (where fundamentals have not kept pace with price increases) and into areas of more value (where prices may not fully reflect underlying fundamentals). |

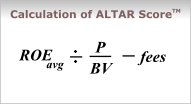

For equities, we calculate the ALTAR Score™ using the formula on the right — itself a derivation of the old Dividend Discount Model — where:

For equities, we calculate the ALTAR Score™ using the formula on the right — itself a derivation of the old Dividend Discount Model — where:

- Avg. ROE is the average return on equity of the companies in the fund for the five (5) years leading up to and including the current-year forecast;

- P/BV is the price-to-book value based on current market prices;

- fees is the annual expense ratio of the ETF.

The ALTAR Score™ is designed to forecast the likely internal rate of return to owners and as such facilitates comparisons between funds, both within a given category or across categories. It helps answer the question, "If I had enough money to buy the business(es) outright and operate them for my own benefit, what kind of returns could I expect on my investment?"

Investors should consider buying ETFs with relatively high scores, and selling or avoiding those with low scores. However the ALTAR Score™ is not a target price, and there are no timing or momentum components to it.

For fixed income securities, investors' returns over the long term are determined by a bond's yield to maturity (YTM), less principal lost when borrowers are unable to repay. For Fixed Income ETFs, we calculate this as follows:

- Adjusted YTM Adds implied inflation back to real YTM for inflation-linked bonds so that all instruments are compared on a nominal basis

- less: Annual "default factor" Our estimate of the impact of potential defaults on investor returns, based on historical default and recovery rates for bonds of similar credit rating and maturities

- less: Expense ratio Annual expense ratio of the ETF

![]() For an in-depth discussion of the ALTAR Score™, advantages and academic foundations, download our Research of ETFs guidebook.

For an in-depth discussion of the ALTAR Score™, advantages and academic foundations, download our Research of ETFs guidebook.